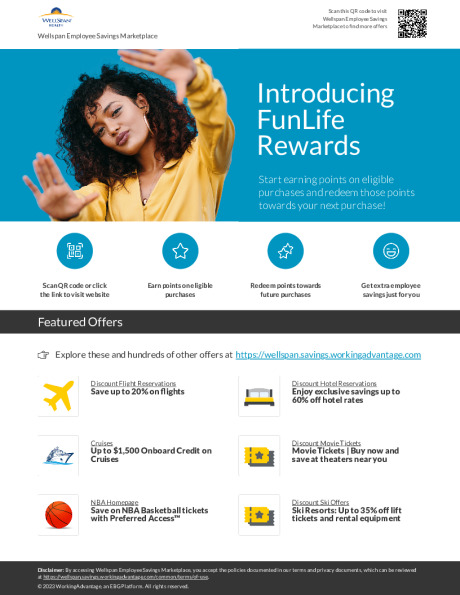

WellSpan Employee Savings Marketplace

The WellSpan Employee Savings Marketplace, provided by Beneplace, is your exclusive

discount marketplace that is updated daily with offers and savings. Through this program, you have access to a wide variety of money saving offers, including discount tickets, cars, rentals, and hotels — as well as amazing product and service deals for your everyday needs. To find out more visit the WellSpan Employee Savings Marketplace or scan the QR code here:

How The Program Works

SAVE ON YOUR FINANCES

• Discover a treasure trove of unbeatable deals and offers on a wide range of financial products.

SAVE ON YOUR WELLNESS

• Maintain a healthy body and mind with a focus on mental, physical, financial, and social well-being offerings.

SAVE ON YOUR BENEFITS

• You have access to group discounts on a variety of insurance products, so you can protect what matters the most.

SAVE ON YOUR TRAVEL

• Access discount flight tickets, hotel reservations, rental cars, tickets to theme parks and attractions, and more.

SPECIAL PERKS FOR YOU

• Access deals and limited-time offers on the products, services, and experiences you need and love

Voluntary Benefits

WellSpan offers you several important Voluntary Benefits through the Wellspan Employee Savings Marketplace. Several of these benefits are available to your year-round, Auto and Home Insurance, Identity Theft Protection and Pet Insurance.

Other important benefits are only available to newly eligible employees or during Open Enrollment, Accident Insurance, Critical Illness Insurance and Hospital Indemnity. If you are a new hire and are interested in these benefits click here to enroll.

Be sure to familiarize yourself with these valuable benefits by reviewing the information on this page.

Accident Insurance

Accident insurance pays a set benefit amount based on the type of injury you have and the type of treatment you need. Coverage provides a benefit in the event of accidental death, dismemberment, hospitalization, injury, recovery, surgery or treatment.

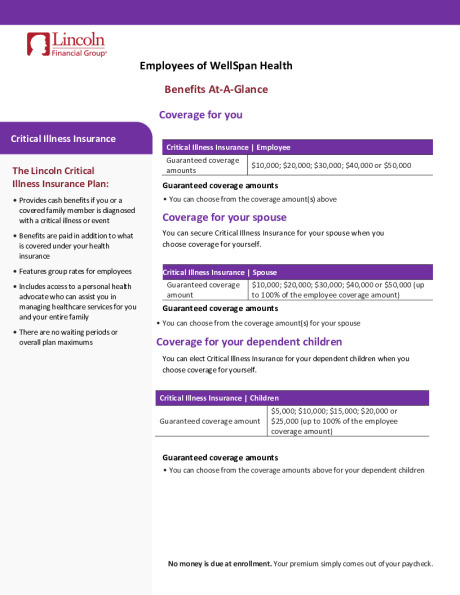

Critical Illness Insurance

Provides a lump sum cash payment, supplementing your medical and disability coverage, to help pay expenses related to unexpected health issues. Spend the reimbursement on any expense, including health care costs, monthly bills or everyday expenses.

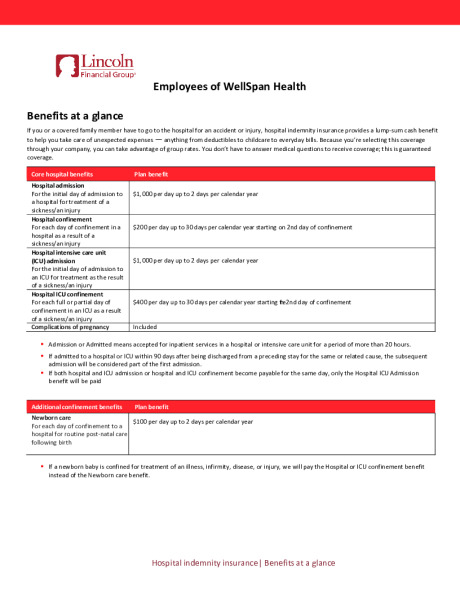

Hospital Indemnity

Pays a lump-sum cash benefit if a covered employee or family member is admitted to a hospital due to an illness or injury. It’s up to the employee how to spend it — they can pay health expenses, their mortgage or other bills, or anything else they find helpful.

Whole Life Insurance

Term and Whole Life Insurance work together to provide comprehensive protection throughout your entire life. Term Life is essential coverage during your working years. Whole Life provides coverage that extends into retirement — at competitive rates when you buy it early. When you purchase both types, you get valuable financial protection that can last a lifetime.

MetLife Pet Insurance

Help make sure your furry family members are protected against unplanned vet expenses for covered accidents or illnesses.

Auto Home Insurance

Protect your valuables and gain access to value-added features and benefits including special group discounts on auto and home insurance specially designed to fit your lifestyle and your budget.